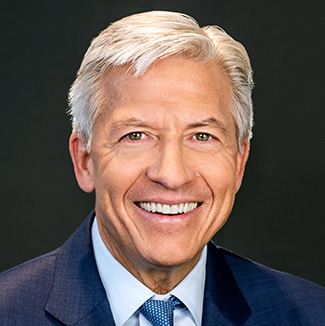

Edward Mulé is co-Founder, CEO and Portfolio Manager of Silver Point Capital, a private investing firm, focused on credit, distressed and special situations. Today, the Firm manages approximately $10.5 billion of invested and committed capital, across its Flagship distressed and special situations hedge funds, Distressed Opportunity private equity funds, and Specialty Credit Funds, which focus on special-situation middle market direct lending. Headquartered in Greenwich, CT, the Firm has over 160 total employees, including over 50 investment professionals.

Prior to founding Silver Point in 2002 with co-founding partner, Robert O’Shea, Mr. Mulé worked for more than 16 years at Goldman Sachs. Mr. Mulé, together with Mr. O’Shea, built and led Goldman’s distressed debt and special situation lending businesses. He headed or co-headed Goldman’s Special Situations Investing Business from 1999 to 2001, the Asian Distressed Debt Investing Business from 1998 to 2001, and associated funds, including the $1.525 billion Goldman Sachs Special Opportunities (Asia) Fund, as well as, in 1996, established a senior secured, special situation lending business while at Goldman Sachs. Mr. Mulé was elected general partner in 1994. Before joining Goldman’s distressed debt efforts in 1995, Mr. Mulé worked for Jon Corzine and Henry Paulson in 1994 and Robert E. Rubin and Stephen Friedman from 1991 to 1994 in the Office of the Chairman. In this role, he assisted the chairmen on strategy and its implementation, as well as reengineering, setting up control and compliance infrastructure and cost cutting. Prior to that, Mr. Mulé was an investment banker in the Mergers and Acquisitions Department from 1984 to 1991, specializing in a number of areas, including telecommunications, consumer products and forest products. He was a member of Goldman’s Senior Traders Committee. Mr. Mulé graduated magna cum laude from the University of Pennsylvania’s Wharton School, contemporaneously receiving both his M.B.A. and B.S. degrees at the age of 21.